While President Trump early moves on trade have left plenty of room for criticism on the specifics, some of it voiced here, it’s important to separate the noise around day-to-day actions from the long-term direction of national policy, and to bear in mind that we’re still at the very outset of the administration. The folks ultimately in charge of delivering on the president’s goals—Vice President JD Vance, Secretary of State Rubio, Secretary of the Treasury Scott Bessent, Council of Economic Advisers chair Stephen Miran, U.S. Trade Representative Jamieson Greer—are the right people in the right places at the right time. They are delivering the right messages. And they are increasingly articulating a clear direction for policy that, if pursued, will do a great deal of good.

In back-to-back columns last week and this week, the Financial Times’ Gillian Tett has done a particularly nice job describing what is going on—for better and worse—and where things are likely headed. So they are your one, OK two, things to read:

What a Mar-a-Lago Accord Could Look Like

Tariffs on Goods May Be a Prelude to Tariffs on Money

Key points:

1. Trump and his team “do not consider financial policy interventions to be retro, but essential if they are to force a grand reordering of global finance and trade.” (See Miran’s Guide to Restructuring the Global Trading System, which I keep telling you to read.)

2. “Trump’s advisers [are not] as terrified of stock market falls or recession as some critics hope, I am told. On the contrary, they have always known that tariffs will unleash some initial economic pain and want to get this out of the way early in Trump’s tenure. Indeed some officials actually see an upside. They think a recessionary shock will force other countries to the negotiating table faster and reduce US interest rates, while lower asset prices would counter the excessive financialisation that has blighted the US economy, particularly if a weaker dollar boosts industry.”

See also Bessent’s comments today, “We’re focused on the real economy. Can we create an environment where there are long-term gains in the market and long-term gains for the American people? I’m not concerned about a little bit of volatility over three weeks.”

3. “Bessent says Trump will ask other governments to put themselves into ‘red,’ ‘green’ and ‘yellow’ boxes — i.e., choose to be foes, friends or adjacent players. ‘Green’ countries will get military protection and tariff relief, but must embrace a currency accord. Some ‘yellow’ — or even ‘red’ — nations might cut transactional deals. There could be two stages with Mar-a-Lago, the thinking goes: one with allies and the second with others.”

4. Keep an eye on capital flows, not just goods trade. “For amid all the tariff shocks, there is another question hovering: could Trump’s assault on free trade lead to attacks on free capital flows too? Might tariffs on goods be a prelude to tariffs on money? Until recently, the notion would have seemed crazy. … But last month American Compass, a conservative think-tank close to vice-president JD Vance, declared that taxes on capital inflows could raise $2tn over the next decade. Then the White House issued an ‘America First Investment Policy’ executive order that pledged to ‘review whether to suspend or terminate’ a 1984 treaty that, among other things, removed a prior 30 per cent tax on Chinese capital inflows.”

5. Tett concludes, “A shift in economic philosophy is emerging that is potentially as profound as the rethinking unleashed by John Maynard Keynes after the second world war or that pushed by neoliberals in the 1980s.” Note that second reference. Everyone is talking about the successor to Bretton Woods, but in some respects the better reference point might be the Volcker Shock of the early 1980s. Bloomberg Economics chief economist Tom Orlik drew this analogy at Wednesday’s Odd Lots Live event in Washington.

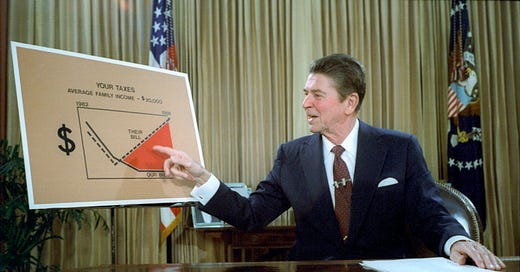

Early in the Reagan administration, as Fed Chair Paul Volcker acted aggressively to end the “stagflation” of the 1970s, the S&P 500 fell more than 30 percent and the economy went into recession. The unemployment rate rose above 10%. The interest rate set by the Federal Reserve hit almost 20%. The stock market was lower on Election Day 1984 than on Election Day 1980. And Reagan won re-election by more than 18 points and 500 electoral votes.

Now, the fact that dramatic economic recalibrations with short-term pain can be enormously popular and successful in the long-run does not mean that economic warning signs are necessarily flashing “keep going.” Sometimes they’re just warning signs. But the point, as Bessent noted, is that short-term market fluctuations are a foolish way to measure a policy’s wisdom or likely effectiveness. Often times the best long-term policy does come with initial costs.

We’ve long been calling for exactly this messaging at American Compass, and our survey research has validated it. Just before the election, we published The American Wake-Up Call, which found that the following message was more popular than the typical one being delivered by either political party:

We have to be honest about the hole we’ve dug for ourselves in America, and the hard work it’s going to take to get back out. I’m not going to promise to make your life easier, because the truth is, things are going to get harder. We’ve been living it up on borrowed money and our kids are going to get stuck with the bill. That can’t go on. We all sense that America is in decline, but decline is a choice. Running up a tab we can’t pay is a choice. And I’m offering you another choice: that we come together and make the sacrifices we have to make to get us back on the right track.

An administration heading this direction marks a welcome departure from the approach typically taken by leaders on both sides of the aisle, and deserves a chance to get it right. They should be held accountable for thoughtful planning, clear communication, and solid execution, and no question there is room for improvement on those fronts. But don’t obsess so much over any felled tree that that you lose sight of what matters most, good stewardship of the forest, which sometimes includes a controlled burn.

BONUS LINK: On Tuesday, American Compass policy advisor Mark DiPlacido submitted comments to the U.S. Trade Representative on the administration’s policy, providing an especially comprehensive yet succinct overview of the underlying problems in the international trading system, the potential promise of replacing it, and how that should look.

WHAT ELSE SHOULD YOU BE READING?

Have Humans Passed Peak Brain Power? | John Burn-Murdoch, Financial Times

I’ve always been fascinated by the theory that lead-poisoning prompted the downfall of the Roman Empire. I have no idea whether it’s true—my vague sense is that the latest scholarship suggests not—but that’s not the point. The point is that it could be true. A civilization could adopt a technology that undermines its own capacity to persist, setting itself on a downward trajectory that it discovers, if at all, only after the point of no return has been passed. The even more bizarre case would be the one where the civilization does discover in time, but decides not to do anything, because TikTok videos are fun and it’s a real hassle to take your kid’s phone away.

Bonus link: EPPC’s Clare Morell offered the definitive take on this challenge in an American Compass essay last year, America On-the-Line, focusing especially on the question of what happens if a society undermines its own ability to govern itself? Relatedly, Morell has a phenomenal new book, The Tech Exit: A Practice Guide to Freeing Kids from Smartphones, coming in June. Pre-order here.

Is Heartland Talent Repressed? | Tom Owens (h/t Aaron Renn)

This is from January, but the data is so interesting that I’m including it here anyway. Many people are familiar with the “National Merit” program—basically, high school sophomores take the PSAT test and those with the highest scores (roughly the top 2%) become semi-finalists, of whom about half are then chosen to receive scholarships. For various reasons that Owens goes into, it’s in many ways a better measure of sheer intellectual aptitude than the later SAT test. And helpfully, the program then publishes where all 8,000 or so matriculate.

What school is the top recipient of this talent? The University of Alabama. Number two is the University of Florida. You’ll find more National Merit scholars at those two schools than at Harvard, Princeton, Stanford, and Yale combined. More National Merit scholars attend public universities than attend private ones. When we hear people complaining we don’t have enough top talent in America, we may need to ask a few more questions about where they’re looking.

How Trump’s FTC Chairman Is Bringing a MAGA Approach to Antitrust Enforcement | Dave Michaels, Wall Street Journal

Trade and labor are two areas where the Trump administration has most obviously put its money where its mouth is in renouncing the old GOP orthodoxy, but antitrust and competition policy is not far behind. The appointments of Mark Meador to the FTC and Gail Slater as the DOJ’s antitrust chief signaled a dramatic shift, and that has been fully confirmed by the agenda that new FTC chair Andrew Ferguson is pursuing. Indeed, if one recalls how controversial Lina Khan’s approach was within the Kamala Harris campaign, it may be fair to say that the Republican Party is now the one that is more aggressively committed to strong antitrust enforcement and promoting robust competition.

Bonus link: Someone secretly recorded what were supposed to be off-the-record remarks by Ferguson at a CEO conference in DC this week. “This isn’t the Bush administration,” he said, “and it’s not the FTC of the ‘90s.”

What Went Wrong at Saudi Arabia’s Futuristic Metropolis in the Desert | Wall Street Journal

If you’re not following the Neom story, you’re missing out. You couldn’t get a movie on this greenlit because the whole thing is so stupid. But it’s also apparently real! My favorite detail in this piece is that McKinsey has been working on it and its fees have reportedly exceeded $100 million in a single year. Maybe they could use some of that to help fund some opioid settlements?

HIGHLIGHTS FROM COMMONPLACE

Reliable Electricity, Reliable Jobs | Brad Pearce. How one innovative manufacturer transformed a local economy.

How Silicon Valley Can Reindustrialize America | David Cowan. Inside Anduril’s bold bet on American defense manufacturing.

Trump's Shipbuilding Imperative | Mike Lind. A libertarian radical sank America’s maritime industry. It needs to be restored.

And Jack Goldsmith, my former professor at Harvard Law School and author of the Executive Functions Substack, joined me on the American Compass Podcast to discuss the legal debates surrounding executive power in the new Trump administration.

Check out the latest every day at commonplace.org, follow us on X @commonplc, and subscribe for the best of each week directly in your inbox.

Enjoy the weekend!

It’s infuriating to watch an elite like Oren crumble. Pretending this is just another normal political debate is so absurd that he loses all credibility. History shows that the elites who acquiesce are as guilty, if not more so, than the actual demagogue. It’s shameful. Let’s hope we have leaders who choose to exhibit a spine before it’s too late.

Yes, but Reagan did not author the circumstances that initiated it.